Asaan Karobar Card Loan Scheme 2025

Chief Minister Maryam Nawaz Sharif has introduced the Asaan Karobar Card Loan Scheme for small and medium-sized entrepreneurs. Under this card, these individuals are being given a loan of Rs. 5 lahks to Rs. 10 lahks at 0% markup by the government. This loan has been launched by the government for small and large entrepreneurs.

If you want to get this card and want to get a loan from the government through this card. Then we have provided all the information in this article to guide you. By knowing which you can easily get all the information about making and getting this card.

| How To Apply Online For Assan Karobar Card Scheme, Check Eligibility and Procedure | Apply Online For Assan Karobar Card Scheme |

|---|

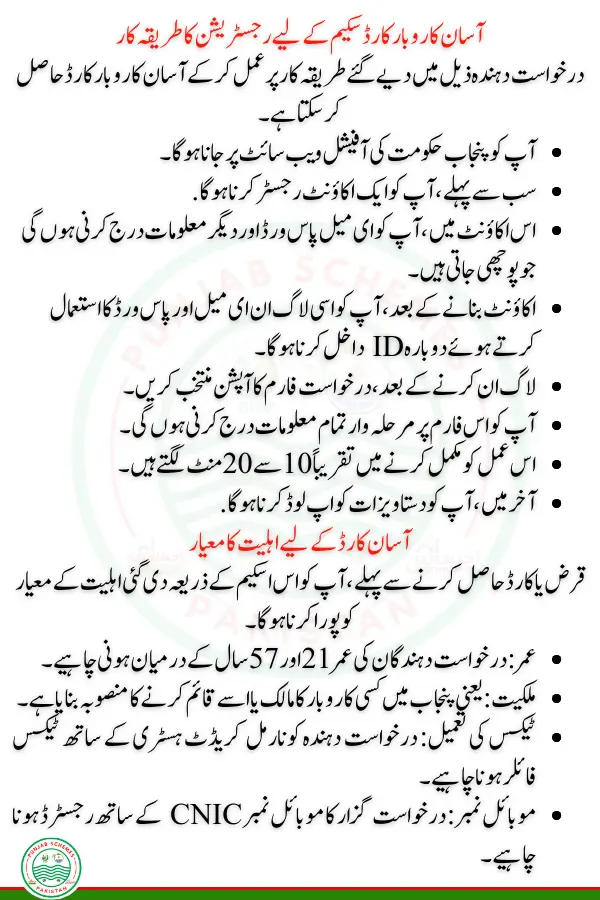

Eligibility criteria for AKC card

Before getting a loan or card, you must fulfill the eligibility criteria given by this scheme.

- Age: The age of the applicants should be between 21 and 57 years.

- Presidency: That is, the owner of a business in Punjab or has planned to set it up.

- Tax compliance: The applicant must be a tax filer with a soft credit history.

- Mobile Number: The applicant’s mobile number should be registered with CNIC.

Required Documents

- You should have a scanned copy of CNIC and a clear photograph.

- Proof of text submission

- Business income and expenditure record

- Property documents or rental agreement for business and residence

- CNIC copies and contact details of references

| AKF Scheme Application Status Check Full Step-by-Step Guide New Update | AKF Scheme Application Status |

|---|

Registration Procedure For Asaan Karobar Card Loan Scheme

The applicant can get an Assan Karobar Card by following the procedure given below.

- You have to visit the official website of the Punjab Government.

- First of all, you have to register an account.

- In this account, you have to enter the email password and other information that is asked.

- After creating the account, you have to enter the ID again using the same login email and password.

- After logging in, select the option of the application form.

- You have to enter all the information step-wise on this form.

- It takes about 10 to 20 minutes to complete this process.

- Finally, you have to upload the documents.

Application Processing Fee

The government has set a non-refundable processing fee of Rs 5,000 for loans from Rs 5 lakh to Rs 10 lakh for Asan Karobar Card. A fee of Rs 10,000 has been set for the Asan Business Finance Scheme. If you want to apply for the finance scheme, you will be given a loan of Rs 10 lakh to Rs 3 crore by the government without any markup.

Also read: Punjab CM Expands “Apni Chhat Apna Ghar” Program

Asaan Karobar Card Loan Scheme Repayment Details

The government of Punjab has allotted a loan repayment period of five years. You will have to repay the loan to the government in monthly installments. Initially, a grace period of six months will be provided by the government, while existing businesses can get a grace period of up to three months.

The government has set a cash withdrawal limit of 25 per cent of the loan limit. Borrowers should register with the Punjab Revenue Authority or the Federal Board of Revenue within six months.

Contact Information For Assistance

For more information about the Asan Krobar Card and Finance Scheme, you can contact the helpline number 1786. You can also visit the website created by the government.

Conclusion

The Asan Business Card Scheme has been introduced by the Punjab government, through which loans ranging from one to one lakh to one million are being provided. If you have not applied to this scheme and want to get this loan. Then submit your application after knowing all this information and get a home loan by being eligible for this scheme. So that you can further develop small businesses.

| Punjab PSER Survey Project 2025: Check Eligibility and Online Apply Procedure | Punjab PSER Survey 2025 |

|---|